Overview of public parking concession transfer in the second quarter of 2023

Release time:

2023-08-16

In the second quarter of 2023, 193 regions in 19 provinces across the country issued TOT transfer projects for public parking management rights, an increase of 192 percent year-on-year and 58 percent month-on-month, including 15 municipal projects, 81 district-level projects and 97 county-level projects.

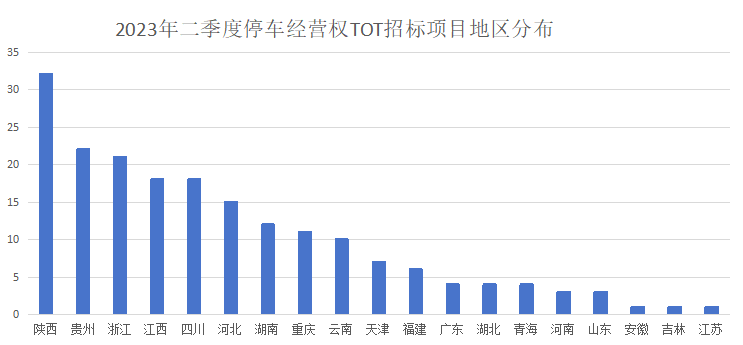

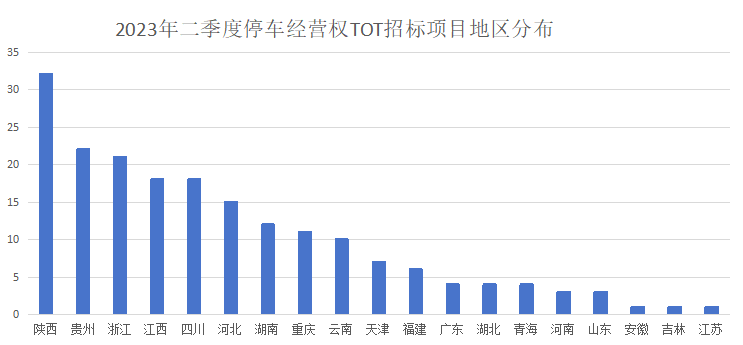

In terms of regional distribution, Southwest and East China are the two regions with the largest number of projects sold, accounting for a total58%, the third is the northwest region, accounting for 19%. From the perspective of the distribution of provinces, as in the first quarter, Shaanxi is still far ahead in the number of sales, ranking first, with 61 sales projects, an increase of 85% from the previous quarter. Guizhou, Zhejiang, Jiangxi and Sichuan ranked second to fifth, with more than 15 sales.

In the second quarter of 2023, the four provinces of Hubei, Qinghai, Jiangsu and Jilin released the transfer project for the first time.

Of the 193 transfer projects, 32 were bundled. "Bundling transfer" refers to the bundling of other types of berths or even other business formats on the basis of road berths and public parking lot berths franchises. Prior to the "bundling transfer" of parking management rights, there have been government enterprises and institutions berths, hospital berths, as well as charging facilities, advertising space management rights, the second quarter of the new housing berths, scenic berths, street light pole management rights, green maintenance rights and management rights and other bundled content.

Number of berths sold from1000 to 90000, with nearly 80% above 5000 berths. The transfer period is between 10 and 30 years, of which 20 years is the most, accounting for 49%, followed by 30 years, accounting for 27%, and 25 years accounting for 14%.

Deal

In terms of transactions, the second quarter had a total170 TOT projects in 18 provinces were sold, with a total turnover of 72.8 billion yuan, up 34% from the previous month. The transaction amount in the first two quarters of 2023 (127.3 billion yuan) is 1.5 times the total amount of last year (83 billion yuan). Among them, Zhejiang has the highest transaction amount, totaling 23.2 billion yuan, Shaanxi ranks second, totaling 12.6 billion yuan, and Jiangxi ranks third, totaling 7 billion yuan. The transfer amount in other provinces is basically below 5 billion yuan.

The transfer project in Zhejiang Province has a characteristic, that is, the amount of a single project transfer is high. In the second quarter, the transaction amount of Zhejiang transfer projects was basically inMore than 0.3 billion, there are 6 projects with a transfer amount of more than 1 billion yuan, and most of the transaction amounts of individual projects in other provinces are below 0.3 billion yuan.

from a singleIn terms of the transfer amount of TOT projects, 86% of the transfer amount of projects in the second quarter was concentrated in 1-1 billion yuan, of which 1-0.5 billion yuan accounted for 62% and 5-1 billion yuan accounted for 24%.

In terms of the selling price per berth, we find by calculation that the selling price per berth per day is inBetween 0.6 yuan and 16 yuan. The average transfer values of East China, Southwest China, Northwest China, North China and Central China are calculated respectively. It is found that the average price is 6.84 yuan/day/berth in East China, 5.32 yuan/day/berth in Southwest China, 3.14 yuan/day/berth in Northwest China, 2.69 yuan/day/berth in North China, and 1.84 yuan/day/berth in Central China. There are few projects sold in Northeast and South China, so no comparison is made here.

AsIn the second quarter of 2023, 23 provinces and cities across the country have issued TOT transfer projects for public parking management rights. In the first half of this year, the transfer of Shaanxi and Zhejiang was relatively concentrated.

So far, the owners of the transfer of parking management rights are basically local urban investment companies. As a local financing platform, they pledge the future parking fee management rights and raise loans from financial institutions, which is one of the ways to solve the local financial pressure.One.

In addition, we found that more and more parking management rights transfer projects"Bundled" into hospital berths, scenic berths, housing berths, charging facilities and even advertising space management rights, street light poles management rights, greening maintenance rights and management rights that are not related to parking, etc., to increase the reserve price, and use the profit image of parking spaces to obtain more loans..

Source: China Parking Network

Share